san francisco gross receipts tax instructions

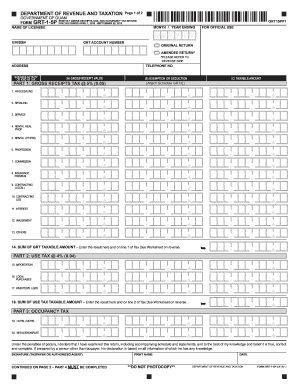

From imposing a single payroll tax to adding a. Your seven 7 digit Business Account Number The last.

Monthly Gross Receipts Example Form Fill Out And Sign Printable Pdf Template Signnow

The small business exemption threshold for the.

. Lessors of residential real estate in San Francisco must file a Gross Receipts Tax Return for each building if they are not otherwise exempt under Code sections 906 and 954 unless they lease. These online instructions provide a summary of the applicable rules to assist you with completing your 2021 return. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

San Francisco ABT 2020 2020 Annual Business Tax Returns To begin filing your 2020 Annual Business Tax Returns please enter. Gross Receipts Tax and Payroll Expense Tax. Lean more on how to submit these installments online to.

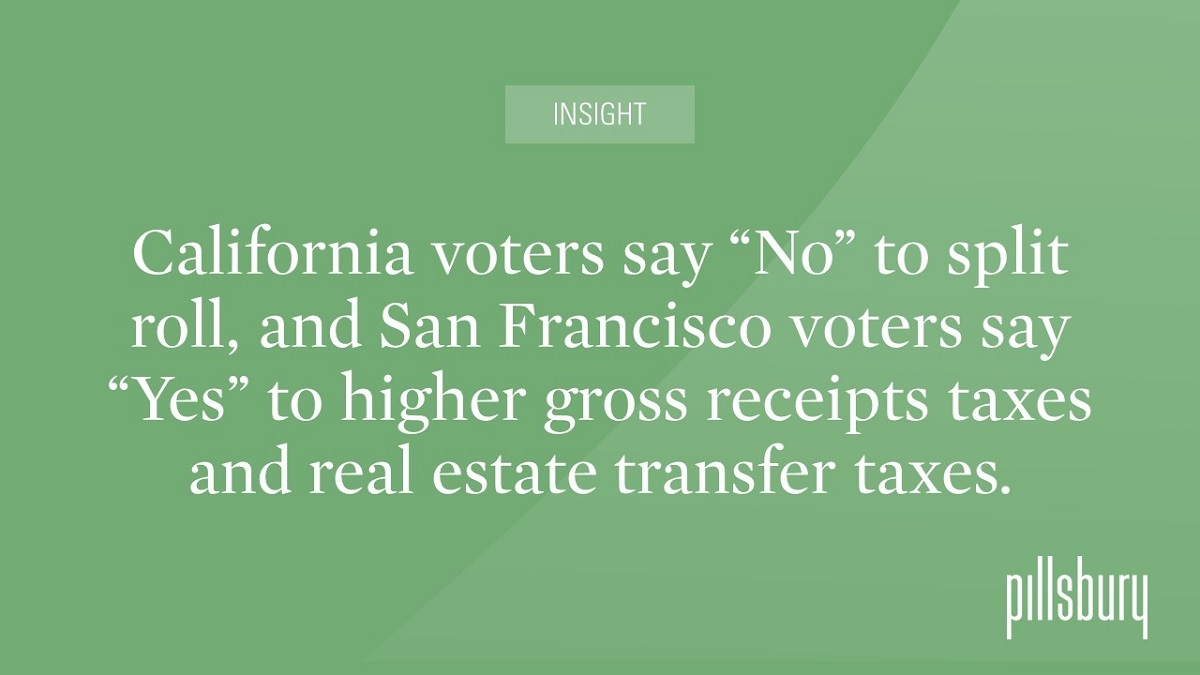

The official printed copy of a Code of Ordinances should be consulted prior to any action being taken. The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other. Retail and wholesale Code Sec 9531 Manufacturing transportation and warehousing.

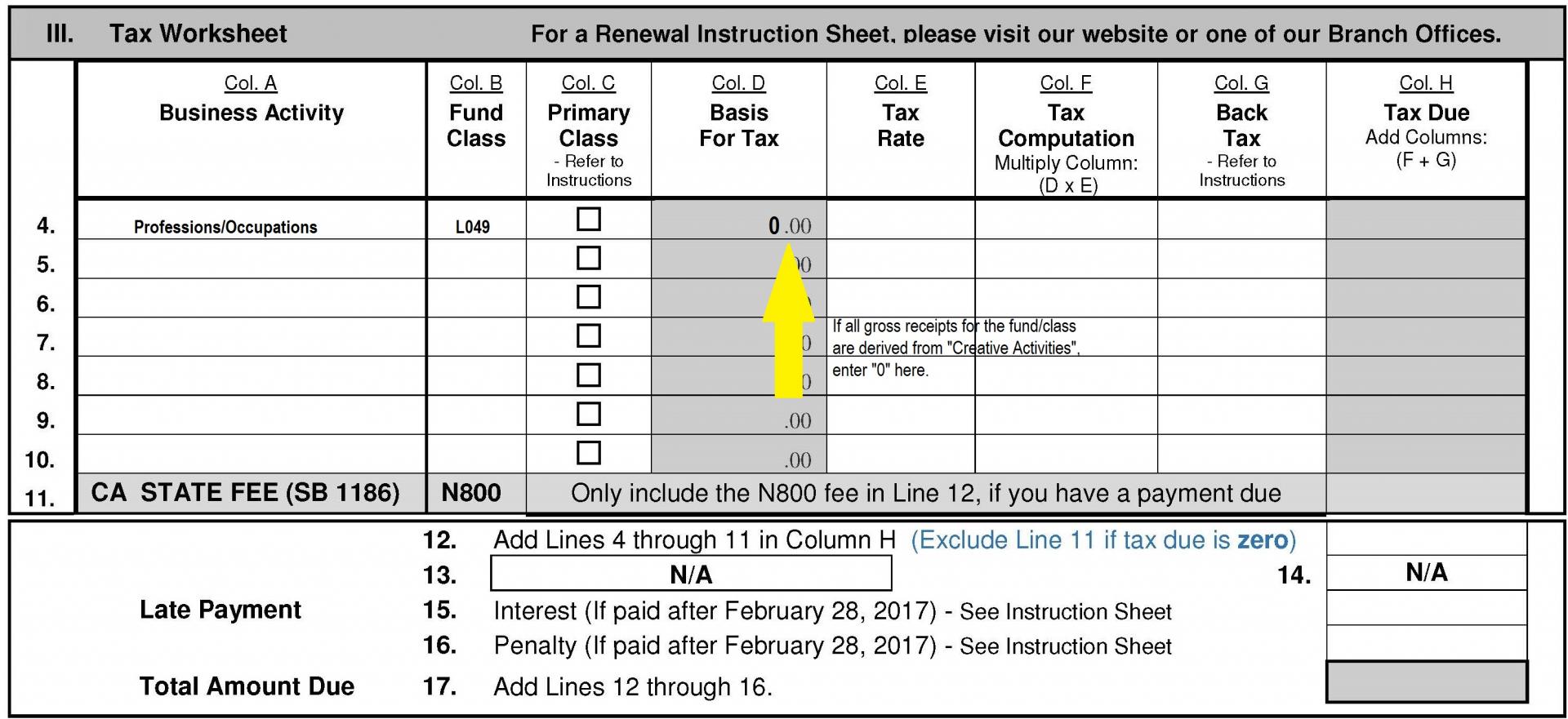

F The amount of gross receipts. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section. The City began making the transition to a Gross Receipts Tax from a Payroll.

In November of 2020 San Francisco voted to. The Homelessness Gross Receipts Tax is applied to combined San Francisco taxable gross receipts above 50000000. Persons other than lessors of residential real estate must file applicable.

Instructions for Reporting 2020 Gross Receipts. For further information regarding the official version of any of this Code of Ordinances. If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the.

Beginning in 2014 every person engaging in business within san francisco is subject to an annual gross receipts tax grt measured by the persons gross receipts from all. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. For tax year 2017 the gross receipts tax rates range from 005625 to 04875.

The City of San Francisco passed The Gross Receipts Tax and. San francisco gross receipts tax instructions Friday September 9 2022 The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation.

Link is external to begin. In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which went. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last.

Enter your login information which was provided in letter you recently received from our office. The Gross Receipts Tax is a graduated percentage depending on the activity code your business falls under in the NAICS system.

San Francisco S Overpaid Ceo Tax Measure Targets Disparity Calmatters

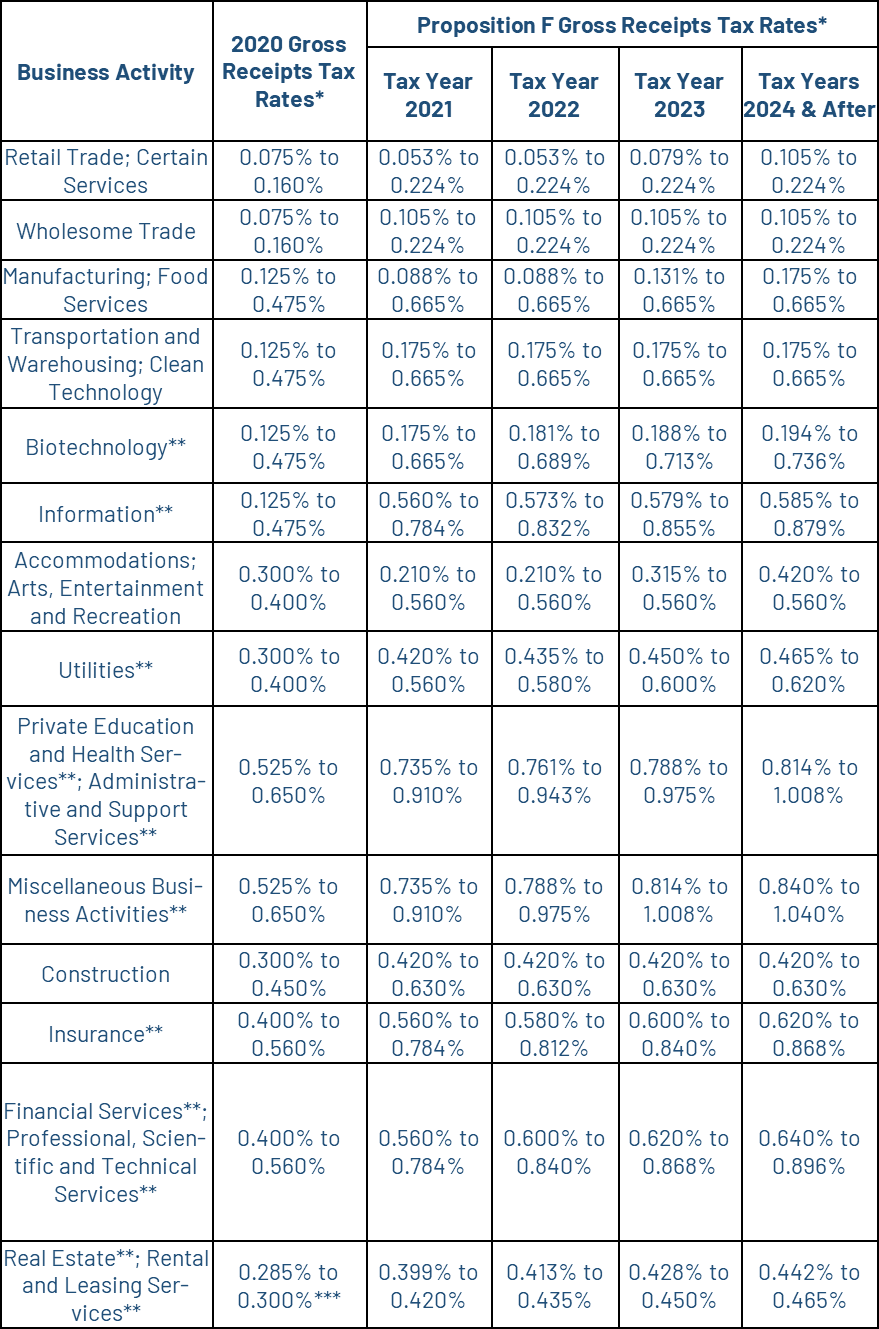

Special Considerations For Los Angeles Business Taxes Filing Due On March 2 2015 Corporate Tax United States

Annual Business Tax Returns 2019 Treasurer Tax Collector

Calif Prop 15 Is Failing While Sf Accepts Bevy Of Local Tax Measures

Annual Business Tax Returns 2021 Treasurer Tax Collector

Local Income Taxes In 2019 Local Income Tax City County Level

Fillable Online Form St Sales Use And Gross Receipts Tax Fax Email Print Pdffiller

Gross Receipts Tax Gr Treasurer Tax Collector

Annual Business Tax Returns 2019 Treasurer Tax Collector

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

What Is Gross Receipts Tax Overview States With Grt More

Self Employed Deductions How To Claim Tax Deductions Without Receipts Marca

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

How To Handle Ebay Taxes The Right Way In 2022

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Jose Cisneros Treasurersf Twitter

Business Tax Renewal Instructions Hollywood Multimedia Los Angeles Office Of Finance

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You